It’s no secret that there are a few ways to price your fee-for-service offerings. One potential solution for your practice is to offer different service tiers that align with clients’ goals, needs, and budgets.

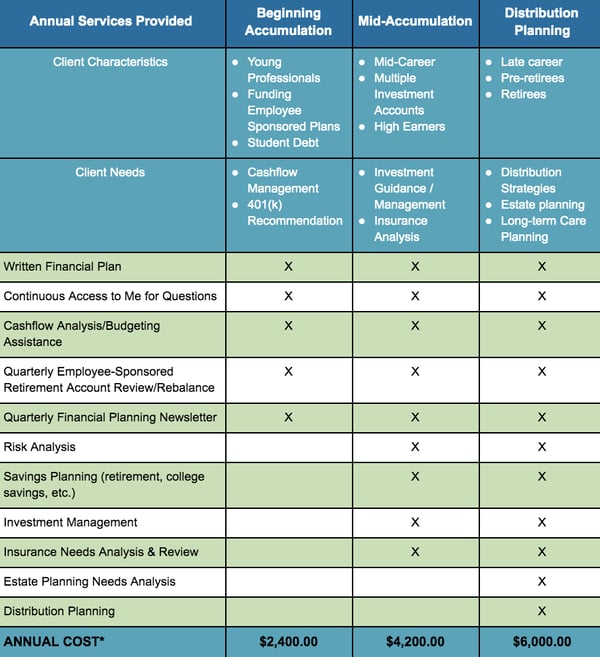

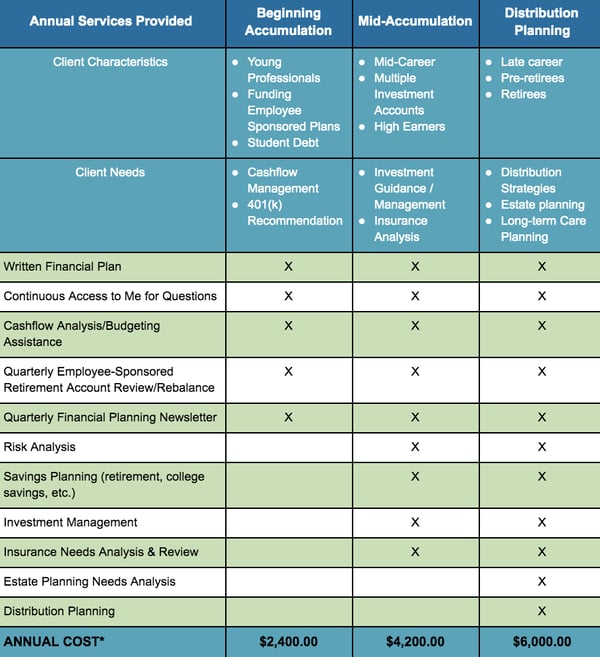

Tiered offerings work by packaging together services that appeal to clients at different stages of their financial journey. A basic tier may include more narrowly scoped services like budgeting advice and a risk analysis. As financial needs become more complex, tiers can expand to include more advanced planning like portfolio rebalancing, college planning, distribution strategies, or estate planning needs analysis.

Tiers can help increase clients’ confidence in their financial plan by allowing them a choice in what services they receive. Of course, when structured well, you’ll know which services would be most impactful and can help clients make the best decision. For clients who are new to financial planning, they may opt for the most basic services, but as you help them progress towards their financial goals, you’ll build trust. As their needs change and potentially become more complex, it’s simple to move them to the next suitable tier.

A written list of services can also make it clear to clients what they can expect from you. This will help you to ensure you’re getting compensated appropriately for the amount of time you’re allocating to each client.

Below is an example of tiered service offerings. Try to stick with two or three tiers, as more than that could become overwhelming to clients.

*Annual Cost can be paid via a monthly, quarterly, or semi-annual frequency

If a tiered offering sounds like a useful approach in your firm, I encourage you to create a list of everything you do for clients (even the seemingly small things like sending newsletters or creating an online portal to aid in financial organization). Group services of similar effort, value, and client need together. While you may not list all of your services in your published tiers, it’ll ensure you’re considering the full amount of time you’ll need to dedicate to each client annually and help you set pricing.

Honor is AdvicePay’s Product Owner. With a passion for innovation and a keen eye for market trends, Honor is at the forefront of driving product development and ensuring customer satisfaction. Having worked in the financial industry for over five years, Honor has honed a versatile skill set that combines technical expertise with a deep understanding of industry needs. When she’s not helping bridge the gap between our product development and strategy, you can find Honor running, cooking, and exploring National Parks with her family.