How to Structure and Establish Pricing

Without a doubt, one of the top questions we hear from advisors implementing fee-for-service is, “How do I structure and establish my pricing?”

The fee-for-service model is attractive because it opens up the ability to work with a large pool of people seeking financial services outside the traditional AUM model. It’s also enticing in its simplicity!

Yet at the same time, it’s fair to say it introduces some complexity for advisors when setting their fees.

How do you sell the value of your time and expertise when you are not selling a product or the assets you’re managing? How do you determine a pricing structure that is both profitable to you and attractive to your clients?

While there are endless ways to calculate your fees under the fee-for-service model, this article will help you get started in pricing out the fee-only aspect of your business – in turn, expanding your ability to serve more people and grow your business.

What will your clients pay?

The first step to establishing the right pricing strategy is to figure out what your clients will pay for your services.

To do this, research the average compensation of your niche customer in the geographic area you plan to serve. Research shows that a reasonable fee is between 2-2.5% of your client’s annual income. This is a good place to set your initial pricing.

From here it’s fair to include stipulations in your contract for an automatic yearly fee increase of 3-5%. This will help you stay ahead of rising business costs and avoid enacting larger, potentially unpalatable fee hikes every few years.

Once you know what you can charge your clients, it’s time to figure out how to charge them.

How will you charge your clients?

Fee-for-service financial planning requires transparency and attention to compliance. In that framework, there are plenty of different ways to charge for your services!

Some of these include flat fees, tiered fees, time-based fees, or project-based fees. Fees may vary based on the client’s income, the complexity of a project, or the staff member assigned to assist with the task.

You may find that one fee structure works best for you, or you may use a combination of fee structures. The most important thing is that you charge a rate that allows you to make the money you want while also remaining competitive in your target market.

For example, if you are working with young physicians, you may be charging $300 a month. If you are working with young professionals, you may be charging them $100 a month.

How often will you charge your clients?

Fee frequency is another important consideration. Your fee-for-service model will work best when it aims to collect fees on a regularly recurring basis (as opposed to only hourly or one-time planning fees).

Historically, ongoing models were not feasible because it was impossible to do so when every client was writing a check! However, with AdvicePay you can easily scale recurring fees. Retainers and subscriptions for ongoing work are far superior to one-off projects and they fit nicely into the fee-for-service model.

Consider this: would your niche be more amenable to a smaller monthly fee, or prefer to pay a larger chuck quarterly or annually? In general, younger people are more likely to happily pay a small monthly fee that is manageable within their budget, while older, more established customers may feel nickel and dimed by that model.

When in doubt, consider your own cash flow needs, ask your clients about their preferences, and consider flexibility for various client situations.

Once you decide on a method for calculating your fees, you can create a fee calculator using the fee calculator tool within AdvicePay. We provide pre-made templates that allow you to simplify fee calculations for a number of different fee structures.

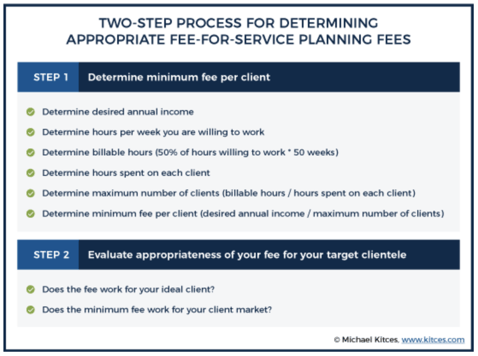

One way to simplify fee planning is with the two-step method outlined below.

How AdvicePay users handle their billing

- 90% of AdvicePay users bill their clients monthly, 9% bill quarterly, and 0.6% bill on a semi-annual basis.

- The average one-time invoice is $1,305.

- Average monthly fees are $216 and upfront fees average $800.

- Average quarterly and semi-annual fees are $885 and $1245, respectively.

No matter how much you charge or how you structure your pricing, we are here to help with all of the aspects of your billing and payment process!

Still, have questions about how to structure and establish your pricing? Check out our other resources:

How 3 Firms Successfully Structure Their Pricing

Share this

You May Also Like

These Related Stories

5 Things People Get Wrong About Fee-For-Service

How to Charge for Fee-for-Service Financial Planning 💵

No Comments Yet

Let us know what you think