How 3 Firms Successfully Structure their Pricing

There are endless ways to calculate your fees when operating under the fee-for-service model. While no single approach is the solution for every firm, trends in payment calculations have begun to appear among financial planners. If you're still trying to determine the best method for you and your business, these three examples may help provide guidance.

FIRM #1 - INCOME AND NET WORTH

ABC Financial works with younger generations of clients, specifically high-earners in the medical field that are decades from retirement. Their typical client has a high income ($200K+), but a small net worth due to student loan debt. They choose to calculate their fees based on Income + Net Worth.

Calculation Breakdown:

- 1% of Income

- 0.5% of Net Worth

Example:

Jim Smith recently graduated medical school and landed his dream job making $180,000. He has a net worth of $50,000.00

- $180,000 x 1% = $1,800

- $50,000 x 0.5% = $250

- TOTAL ANNUAL FEES: $2,050

Benefits of Income + Net Worth Calculations:

- As you help clients reach their financial goals, your revenue will keep pace with your time spent on a potentially more complex plan and the overall value you're providing.

- This is a simple pricing structure that is easy for clients to understand and simple for you to calculate.

Things to Consider:

You'll want to decide how often you'll update their fees. Should this be an automatic change after one-year? Do you want to update all client fees at the beginning of the year?

Fee Calculation Configuration:

FIRM #2 - COMPLEXITIES

XYZ Retirement Planners works with high net worth pre-retirees and retirees. Their clients have been looking for transparent fees and to preserve their investment accounts. XYZ Retirement has begun offering the fee-for-service model and is happy with how well it's been received by clients. While their clients have similar goals and situations, there are certainly some clients with complex situations. They decide to base fees off complexity of needs.

Calculation Breakdown:

- Marital Status:

- Partnership & No Kids: $600

- Partnership & Kids: $850

- Single & No Kids: $300

- Single & Kids: $500

- Number of Qualifying Accounts:

- 0 - 1: $0

- 2 - 3: $200

- 4+: $400

- Number of Non-Qualified Accounts:

- 0 - 1: $0

- 2 - 3: $200

- 4+: $400

- Years Until Retirement:

- < 10 years: $500

- 10 - 25 years: $200

- > 25 years: $0

- Consumer Debt:

- < $20,000: $0

- $20,000 - $100,000: $200

- > $100,000: $500

Example:

Sam and Sally Johnson are in their mid-40s with two children, ages 14 & 11. They've worked hard to save into their retirement nest egg and their children's education funds. They'd like to retire in 20 years and agree they'll need professional assistance from a financial planner to ensure they feel confident going into retirement.heir advisor determines their fees using their pre-set complexity calculator.

- Marital Status: Partnership & Kids: $850

- Number of Qualifying Accounts: 4+: $400

- Number of Non-Qualified Accounts: 2 - 3: $200

- Years Until Retirement: 10 - 25 years: $200

- Consumer Debt: $20,000 - $100,000: $200

- TOTAL ANNUAL FEES: $1,850/year

Benefits of Complexity Calculations:

- Set transparent, custom fees for each client based on their specific needs

- Expand your client base by accommodating various financial needs/situations

- Ensure you're compensated fairly for the amount and type of work you must do for each client's unique situation

Things to consider:

- Similar to the income + net worth calculations used above, you'll want to decide how often you'll update their fees. Will you adjust at their annual review, or will all clients fees be recalculated at the start of the new year?

- Creating your initial pricing plan can take a bit of work.

Fee Calculation Configuration:

If you're interested in this approach, you can view our built-in complexity calculator as a reference by going to Tools > Fee Calculator > New Calculator > Complexity Based.

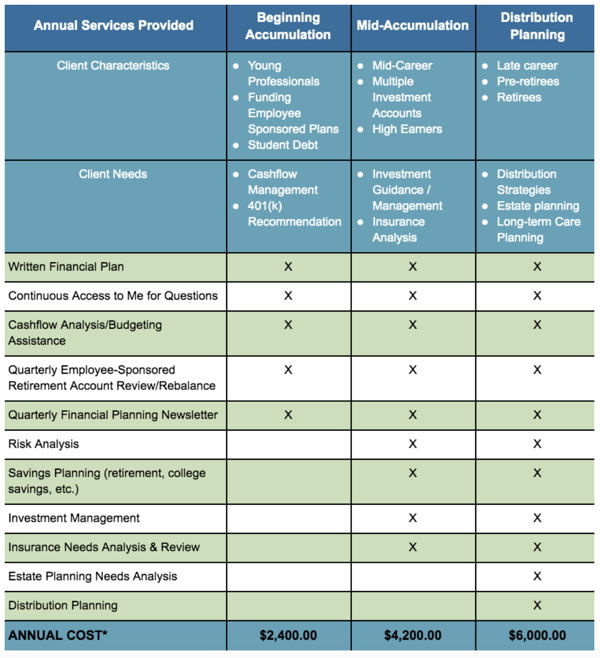

FIRM #3 - TIERED STRUCTURES

Mountain Financial Planning firm works with a wide range of clients. They began as retirement planners but saw an opportunity to work with their clients' adult children who were beginning their professional lives. They decided to offer a tiered service offering so they could be compensated fairly, no matter what stage their clients were in.

Calculation Breakdown:

- Tier 1 (Beginning Accumulation): $2,400/yr

- Tier 2 (Mid-Accumulation): $4,200/yr

- Tier 3 (Distribution Planning): $6,000/yr

Example:

A new prospect, Jan Smith, has worked in the hospitality industry for 20 years. She's saved into her employees 401(k) as well as non-taxable accounts, and has saved $350,000. She's planning to retire in 20-25 years and realizes she needs more help managing her finances. She decided (with the guidance of Mountain Financial Planning) that the Mid-Accumulation tier makes the most sense for her goals and current situation.

Benefits of Tiered Services:

- This structure gives clients the flexibility to choose what level of service they require. Of course, as their advisor, you can discuss which service you recommend and why.

- Tiered services are very straightforward for you and clients.

Things to Consider:

- All clients may not fit nicely into a tier.

- Choose a small number of tiers (3 works great). Too many tiers can be overwhelming for clients and you to manage.

- How will you be compensated if a client needs help with a one-time project that is outside of their tiers scope? Consider having an hourly charge for these situations, and be sure clients know the cost is upfront!

Fee Calculation Configuration:

If you're interested in learning more about tiered structures, check out our article, USING TIERED SERVICE OFFERINGS FOR FEE-FOR-SERVICE FINANCIAL PLANNING.

These methods for calculating fees help ensure transparency that clients love and allow you to receive fair compensation for the value you're providing. While you'll have to put in a little leg work to initially determine the pricing structure (and amounts) that serve you and your clients best, AdvicePay's fee calculator takes the manual calculation off your plate.

Still have questions about payments? Check out these other articles:

- How Often Should I Bill My Clients?

- Why Ongoing Planning can be More Valuable than a One-time Engagement

- AdvicePay Fee Calculator: Calculate Your Fees Quickly and Easily

Share this

You May Also Like

These Related Stories

How to Structure and Establish Pricing

How to Charge for Fee-For-Service Financial Planning

Comments (1)