This Secure Act 2.0 Provision Expands Fee-for-Service Planning Opportunities for Small Business Clients and Their Employees

Fee-for-service financial planners can help small business clients maximize expanded tax credits by establishing a new retirement plan for employees

“Nothing is certain except for death and taxes,” goes the famous saying, and with Congress’s recent approval of the Secure Act and Secure Act 2.0, taxes remain firmly established as a certainty for all American households. Financial planners who offer fee-for-service engagements frequently assist taxpayers and small business owners in navigating the complexity of the tax code to make the most of incentives, deductions, and credits for which households are eligible.

However, one of the tax credits expanded by both the Secure Act and Secure Act 2.0 may not be claimed by a small business unless the company changes the way it pays for startup and administration expenses related to new retirement plans. Fortunately, billing for qualified startup expenses with a solution like AdvicePay enables financial planners to generate revenue for retirement plan administration services while allowing small business owners to maximize the tax credits available to them under the updated tax law.

How Secure Act 2.0 Expanded Tax Credits for New Retirement Plans

The first Secure Act, known as the “Setting Every Community Up For Retirement Enhancement (SECURE) Act, is a federal law passed by Congress in 2019 that became effective on January 1, 2020. The Secure Act expanded tax credits for businesses that created new retirement plans from the previous limit of $500 up to a maximum of $5,000, with an overriding limit of 50% of the administrative costs paid. Small businesses could claim this tax credit for the first three years of the retirement plan’s existence.

The passage of the Consolidated Appropriations Act, 2023 in late 2022 along with its Secure Act 2.0 provision, increased the incentives for small businesses to create new retirement plans, particularly for businesses with 50 or fewer employees. Beginning in 2023, an eligible employer with 50 or fewer employees may claim up to 100% of its qualified startup costs for adopting and maintaining a new SEP, SIMPLE IRA, or qualified plan (like a 401(k) plan), and the credit may be claimed for three years. Employers with 51 to 100 employees are subject to the limits specified in the original Secure Act.

(Note: Determining the specific eligibility of the business and the limits of qualified startup costs under the Secure Act is beyond the scope of this article, but more information can be viewed in these posts on IRS.gov and Kitces.com)

Qualified Startup Costs Under the Secure Act

The Secure Act identifies qualified startup costs for retirement plans as the ordinary and necessary expenses paid or incurred by a small business to:

- Establish or administer a qualifying retirement plan, and

- Educate employees about the plan

Retirement plan administrative fees can be paid by either the retirement plan participant or the plan sponsor, depending on how the plan is established. For many traditional retirement plans, employees typically pay administrative fees based on a percentage of their plan’s account balance. However, fees paid by plan participants are not eligible expenses that the business can claim under the qualified startup cost tax credit, as the business does not directly incur the cost.

Therefore, businesses will want to determine what methods it can use to directly pay for plan administration and employee education expenses in order to claim eligible expenses under the tax credit. One of these methods is a fee-for-service engagement with a financial planner.

How Fee-For-Service Engagements Support Small Business Tax Credits

Businesses can pay for qualified startup costs related to a new retirement plan by working with a service provider under a fee-for-service engagement. Under a fee-for-service engagement, costs paid by the employer to establish, administer, and provide employee education for a new retirement plan all qualify as eligible expenses that the business can claim on its tax return. Note that fees related to plan consulting, investment advisory, or investment management are not considered qualified startup costs under the Secure Act.

Billing employers for qualified startup costs under a fee-for-service engagement is easy with AdvicePay. Retirement plan administrators can generate invoices for the costs associated with establishing and administering an employer’s plan, as well as providing employee education, and the employer can use the AdvicePay portal to submit payments safely and securely, with the convenience of ACH or credit card payments. Again, employers with 50 or fewer employees may claim 100% of eligible expenses, up to a maximum of $5,000, for each of the first three years from the start of the new retirement plan, which can be a significant tax incentive for the employer while simultaneously supporting employee opportunities to improve their retirement savings.

Financial Institution Support for Secure Act Tax Credits

Financial institutions will also want to consider how best to structure the billing of startup and administrative costs for new retirement plans established for small businesses. A growing percentage of employers are increasingly paying for plan administrative costs directly, but according to Callan’s 2022 Defined Contribution Trends Survey, 58% of all administrative fees were still paid entirely by participants, making these payments ineligible for the business tax credit.

Institutions can introduce the AdvicePay platform to their affiliated advisors who help administer small business retirement plans, giving the advisor the opportunity to bill the employer directly for the costs of starting up a retirement plan. A fee-for-service engagement can be established between the advisor and the employer, renewed for up to the first three years of plan administration, so that the employer maximizes its available tax credits. Following the three-year engagement, the advisor and employer can reevaluate how plan administration costs are paid going forward.

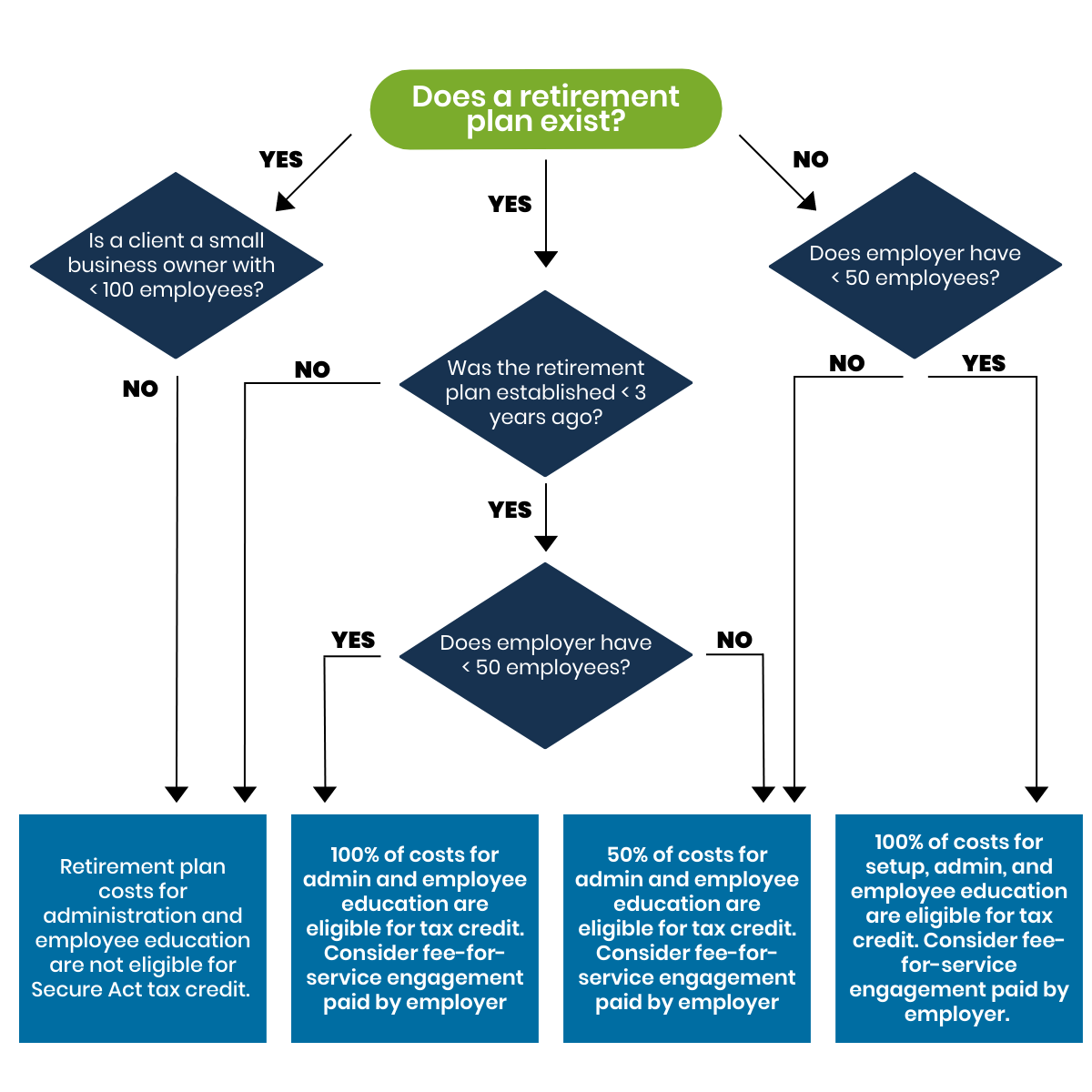

The diagram below illustrates an example workflow of when to consider fee-for-service engagements for small business retirement plan startup and administration costs.

Implement Fee-for-Service Engagements with AdvicePay for Plan Administration

The Secure Act and Secure Act 2.0 expanded incentives for small businesses to establish new retirement plans for employees by offsetting the cost of plan expenses with tax credits. However, the majority of retirement plans are structured so that participants pay all of the administration costs, preventing the company from claiming tax benefits.

Implementing fee-for-service engagements with AdvicePay for plan administration and employee education services allows advisors to support small businesses with their retirement plan needs, reduces the cost burden offset by generous tax credits, and also enables the company to provide valued benefits to its employees.

**Please consult a tax professional for guidance specific to your situation; AdvicePay does not render tax advice.

Ready to Get Started with AdvicePay?

Share this

You May Also Like

These Related Stories

Unlocking the Power of AdvicePay: Revolutionizing Fee-for-Service Financial Planning and Driving Advisor Adoption

How to Create an Annual Client Service Calendar for Financial Planning Engagements

No Comments Yet

Let us know what you think