The economic challenges of 2022 combined with the rapid increase of inflation and interest rates motivated clients to seek out more than just investment management services from financial professionals. People not only want real financial planning, they need it.

So what does this mean for financial firms and professionals? It's time to embrace change, adopt new technology, and deliver more benefits to clients. Here are three key trends from AdvicePay's 2023 Fee-for-Service Industry Trend report you can consider for your business.

First, adding fee-for-service financial planning engagements to your business is a great way to provide the services clients seek while simultaneously creating a predictable recurring revenue stream that isn't tied to the stock market's volatility. It's a win-win! Plus, with clearer expectations in mind, clients are willing to pay a reasonable price for their financial planning. Research shows that reasonable pricing is between 2-2.5% of your clients' annual gross income.

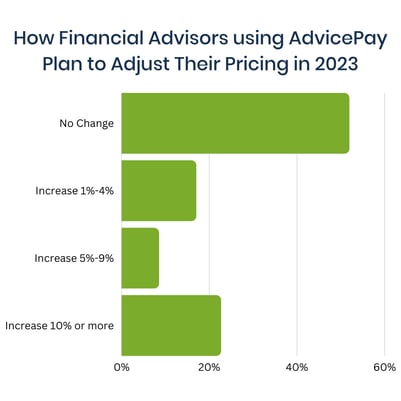

Second, let's talk about inflation and adapting your pricing. In 2022, the year-over-year inflation rate for the United States exceeded 6.45%. To maintain consistent profit margins as your business grows, automatic price increases or escalations can be a great solution. Financial advisors using AdvicePay increased their average prices in 2022, generally keeping pace with inflation. Monthly subscription pricing increased by 4.8% from 2021, and pricing for one-time planning engagements increased by 8%.

Finally, the demand for real financial planning is on the rise, and it's time for firms and professionals alike to adapt. According to a recent Cerulli report, 82% of financial advisors' clients expect to receive financial planning services in 2023, up from 75% in 2022.

Adding fee-for-service financial planning engagements to your business can provide the services clients are seeking while creating a steady (and less volatile!) revenue stream. Plus, with increased transparency regarding costs, clients can more easily value the benefits of your services and ultimately agree to pay for their financial planning engagement.

This is your opportunity to take action now to embrace change and adapt your pricing strategy to meet the challenges of today's economy.

Explore more trends in the 2023 Fee-for-Service Industry Trend Report.

Interested in delving deeper into the trends of the fee-for-service industry? Click the button below to get your hands on a copy of our 2023 Fee-for-Service Industry Trend Report and stay ahead of the game!

No Comments Yet

Let us know what you think