Step-by-Step Guidance on Implementing AdvicePay in the New Year

Is your practice ready to stretch beyond the AUM model and start growing through fee-for-service offerings? AdvicePay is here to help advisors grow their businesses in 2021 and beyond.

Due to the fact that only 5-7% of Americans have over half a million dollars for advisors to manage, the fee-for-service model continues to grow in popularity for advisors and clients alike. Charging clients on an hourly, project-based, and subscription model provides many business benefits, enabling you to grow with the 90% of people not working with an advisor.

AdvicePay is the tool your company needs to help you grow your clientele and facilitate a safe and secure way of collecting payment. We've compiled a few tips to help you prepare for an AdvicePay implementation.

DETERMINE YOUR FEE STRUCTURE

The ways by which you can structure advice fees can vary widely depending on your clientele and what they are willing to pay. You also want to consider your own business goals and income desires depending on what you want to achieve. There are four commonly used ways to structure your pricing -- a flat fee, tiered fee based on services, an hourly or time-based fee, or a project-based fee.

Once you've determined the pricing structure that provides the most value to your ideal client, the next step is actually calculating fees for each client. No matter how you determine fees, with AdvicePay's fee calculator, you can build a fee calculator to ensure you're able to quickly and accurately enter payment amounts. AdvicePay's fee calculator makes it easy to enter payment amounts accurately every time.

Check out this guide to get a step-by-step approach to pricing out the fee-only aspect of your advising services.

CLIENT COMMUNICATION

If you are currently in the changeover phase from a model that relies more on AUM to one that adopts fee-for-service, your first marketing stop should be with your current clients. You should know from the outset that many people might be resistant to the change, and proposing new fees to clients isn't always easy. However, this can also be a tremendous opportunity to communicate the value of your financial planning in a clear and accessible way. Download our client communication prep sheet that will walk you through the questions to address when sharing the value of your financial plan.

There are a few tactics you can use to introduce fee changes:

- Clearly state the problems that you are solving for and areas that you work on with your clients. This could be college planning, tax planning, or buying a house, for instance. You can also state your process for conducting financial planning. For example, this could include establishing the cadence and format of meetings or outlining specific deliverables that you will provide. This sets a clear expectation for both you and the client prior to engaging in any type of planning.

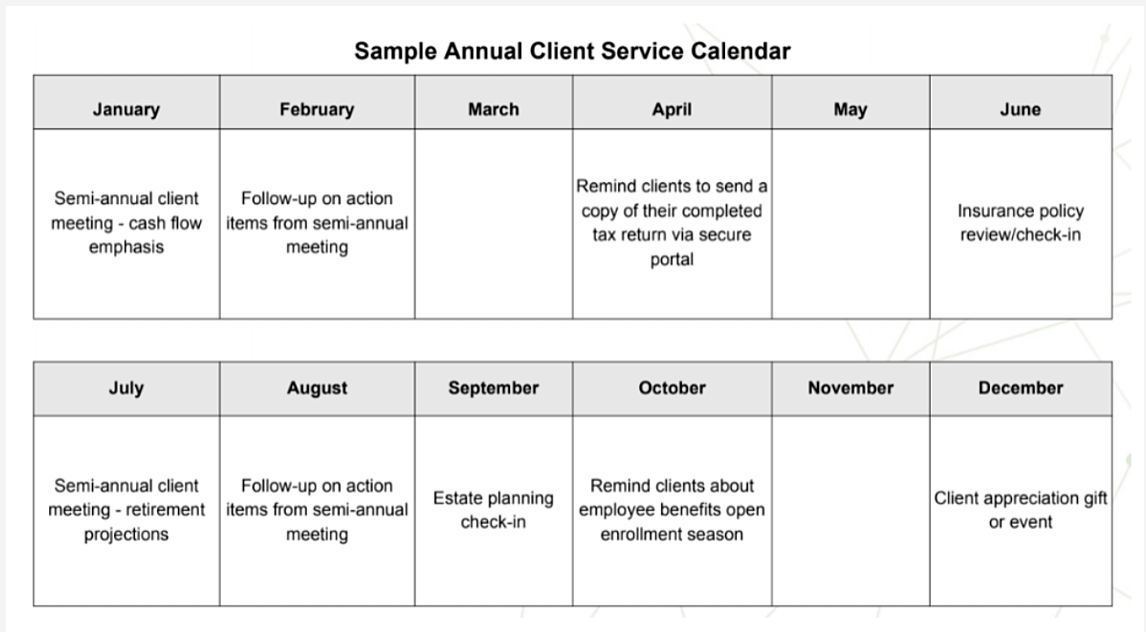

- Establish a "client service calendar." This will provide an outline of the exact items you will do throughout the year, clearly showing your value. See our example of this below --

The last item you will want to communicate is the technologies that you plan to have your clients set up so they are as prepared as possible. Regarding AdvicePay specifically, you will want to inform them that payment for financial services will occur electronically in a safe and secure platform. To make it easy for you, we have compiled a one-pager outlining why you are using AdvicePay for you to share with your clients and prospects.

GET STARTED WITH ADVICEPAY

Now that you've started the process of determining your new fee structure and have prepared a communication plan with your clients, it's time to start the process of getting set up with AdvicePay!

We highly encourage new users to sign up for a 14-day free trial to use the system to test out client workflows. If you'd prefer to get started with an overview of AdvicePay, we also provide bi-weekly live demos.

Our team is here to help you re-think your business model, strategically introduce planning fees into your practice, and reach your business goals. The financial planning industry is rapidly evolving, and it's time to seize these opportunities to expand and grow your practice.

Share this

You May Also Like

These Related Stories

Automate Your Fee-for-Service Workflow with AdvicePay’s API

Unlocking the Power of AdvicePay: Revolutionizing Fee-for-Service Financial Planning and Driving Advisor Adoption

No Comments Yet

Let us know what you think