The "Why" Behind AdvicePay's Fee Calculator

The financial services industry has seen changes over time in how advisors get paid, moving from commissions to assets under management (AUM) to the recent shift toward fee-for-service.

Under both the commission and AUM models, pricing these services was relatively straightforward. If you were a broker receiving a commission that commission was set by the company of the products you were selling, meaning you didn’t have to think about or set prices yourself. Then, as the industry moved to the AUM model, 1% of the assets managed quickly became the standard fee. While advisors might decide to charge a little more or less than 1% or offer breakpoints for clients with more assets, the fee was clear and relatively consistent. Again, advisors didn’t have to spend much time deciding on their fees.

Today, however, the fee-for-service model introduces some complexity for advisors when setting their fees - because when you’re getting paid for your advice (and not a product you’re selling or the assets you’re managing), you are selling the value of your time and the advice you offer to your clients. And how do you determine how much are you worth?

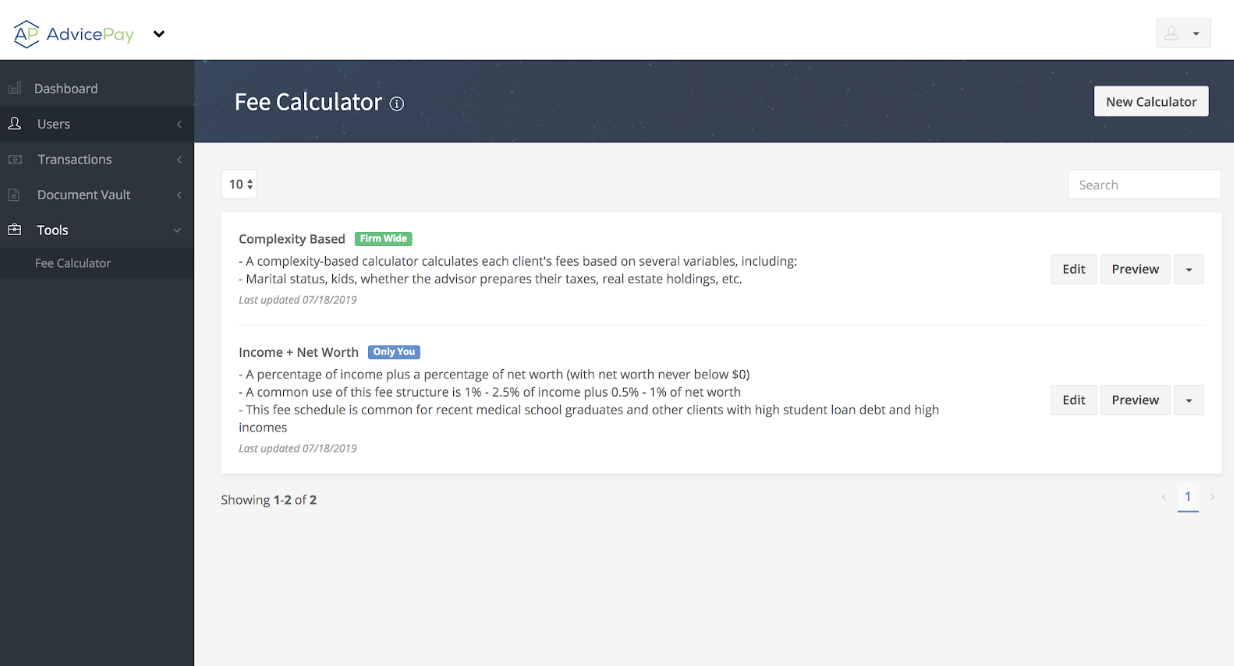

AdvicePay’s Fee Calculator

With that in mind, AdvicePay has built and launched a fee calculator within our app to allow advisors to calculate their fees and even tie them to a client’s invoice! While there are several considerations and ways to calculate fees, we have included templates to help guide you through the process.

5 Ways to Calculate Fees

Here are five ways we see advisors calculating their fees, though this certainly isn’t a comprehensive list:

- Flat Fees

- You know your target client, what they need, and the complexity and time required to deliver it. Your niche is clear, and so you set one fee for all of your clients.

- Example: all of your clients pay $6,000 annually billed at $500/month.

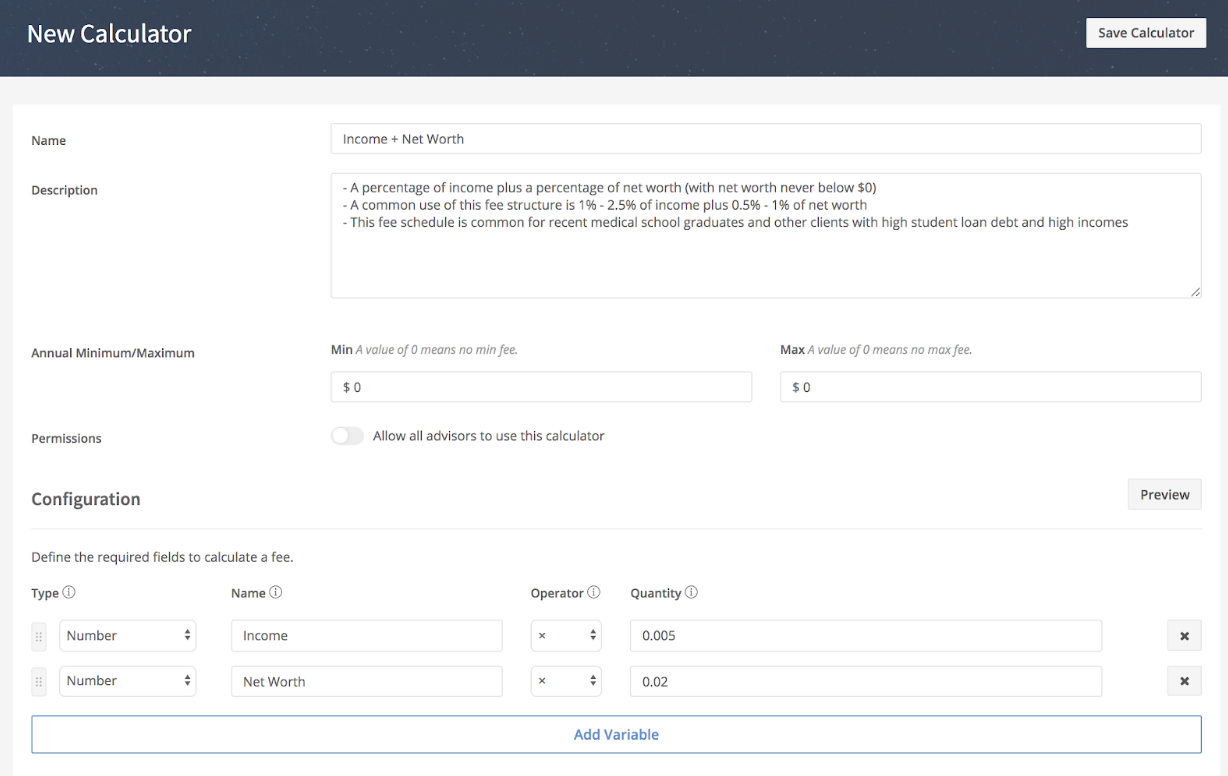

- Income + Net Worth

- To account for the increased complexity and time that is often required for clients with higher levels of income, assets, and net worth you calculate your fees based on a percentage of their income and net worth.

- Example: all of your clients pay 2.0% of income plus 0.5% of net worth.

- This means that a prospect coming to you with $100,000 of income and $200,000 of net worth would pay you $3,000 annually or $250 monthly.

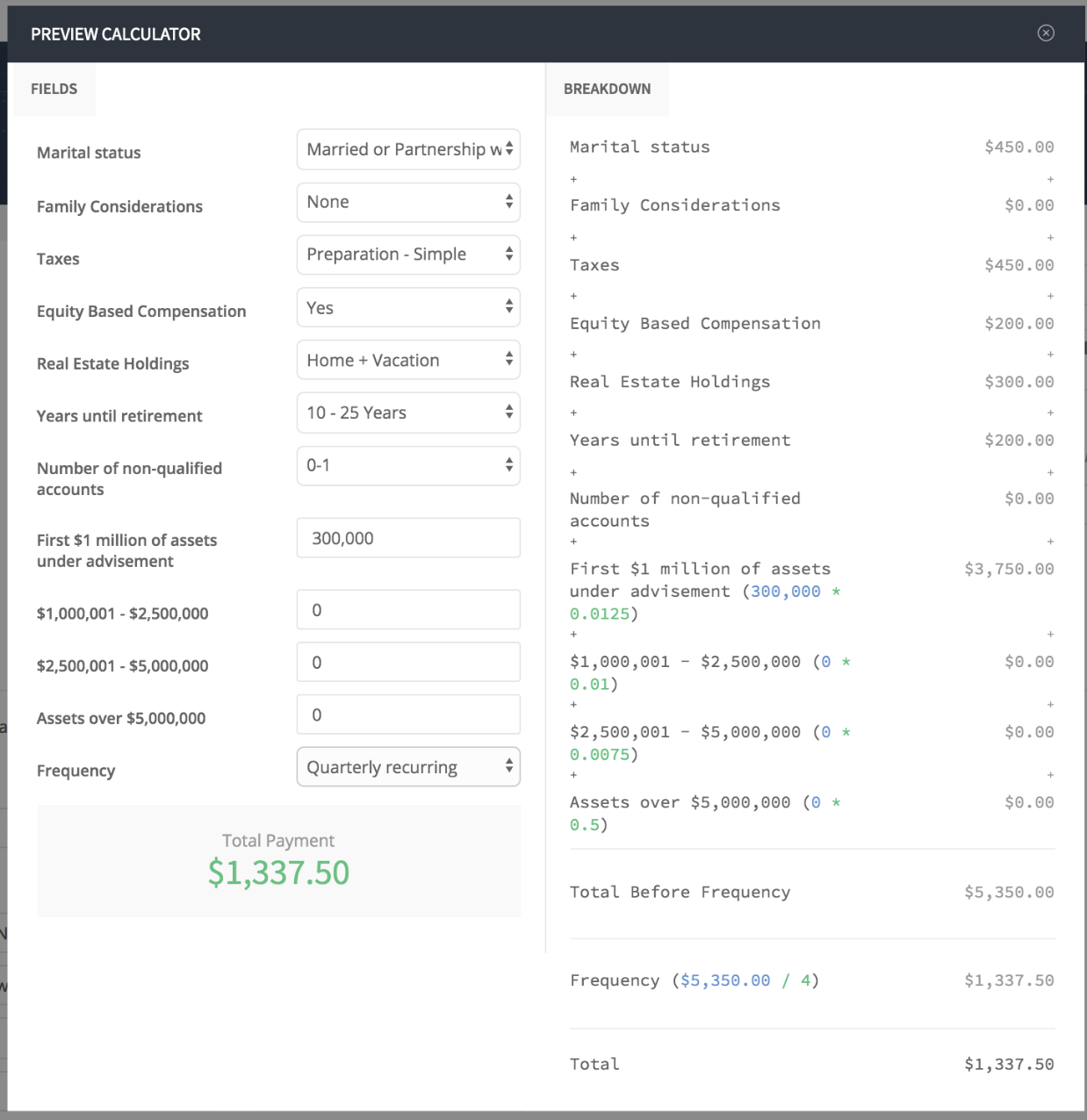

- Complexity-Based

- Your fees focus on the complexity involved in building a financial plan for each client. Using multiples and factors you calculate a client’s fees based on their marital status, how many kids they have, whether they own a business, their real estate holdings, and whether they have student loans, for example.

- Here, you consider the various aspects of someone’s life that add complexity to the work you will do for them and adjust their fees accordingly.

- Tiered Assets Under Advisement (AUA)

- For 401(k) plans and other accounts that you are unable to bill from directly, you may collect a fee through AdvicePay for the work you do to advise on these accounts.

- Example: A client has a 401(k) and other assets under advisement. You bill them at a rate of 1.0% on the first million, 0.5% on the second million, and 0.25% on anything beyond $2 million.

- You can use our fee calculator to determine this amount each quarter and then bill your client accordingly.

- Complexity-Based + AUA

- For advisors who are billing for both financial planning and on an AUA basis, a blended calculator can be a very valuable tool. This allows you, as their advisor, to calculate a combined fee for both the complexity-based financial planning work and the AUA they are managing.

- With one calculator you can determine the total bill for your client and only bill them once per billing period rather than separating each fee into two bills.

Don’t Forget Your Niche

Of course, the key to setting your fees under the fee-for-service model is to first know what your ideal client looks like. You have to establish your niche!

As a general rule, charging a client 1-2% of their income is affordable and within their means.

When your niche and ideal client are clear, it becomes much easier to predict their average levels of income, net worth, and complexity to give you a clear range for what to charge your clients. Using the features within our fee calculator, you can set minimum and maximum fees that will override what the calculator spits out. If you determine that to profitably run your business no client should pay less than $2,400 annually, you’ll set this as your minimum fee.

At AdvicePay, about 80% of the ongoing subscriptions are billed on a monthly basis while 20% are billed quarterly. We see a range of monthly fees from $100 - $500 with the average being about $250/month. The average ongoing quarterly fee is around $700. That said, these are statistics. If you work with Fortune 500 executives with stock options and complex executive compensation plans you will charge them differently than advisors working with missionaries living overseas or school teachers.

Know who you serve, serve them well, and charge them for the value you provide!

Get detailed instructions on how to use the fee calculator here.

Ready to try AdvicePay?

Sign up for a free 14-day trial of AdvicePay.

Share this

You May Also Like

These Related Stories

AdvicePay Fee Calculator: Calculate Your Fees Quickly and Easily

Webinar Replay: Fee Calculator Demo

No Comments Yet

Let us know what you think